IRA Rebates and Tax Credits for New Jersey Homeowners

Updated March 2023

With the passing of the Inflation Reduction Act, saving money on heat pump installation is easier than ever for New Jersey homeowners.

According to the details in the IRA, up to $14,000 is potentially available* in direct consumer rebates and tax incentives for New Jersey homeowners like you to buy heat pumps and other energy-efficient home appliances.

Rely on Your Trusted Experts

There is a lot of conflicting information and advice on the Internet and in other media channels about these programs, and it’s not all entirely accurate.

When it comes to IRA heat pump rebates, your local Carrier dealer will know best how to guide you once the rebates are rolled out later this year.

We recommend you consult with your trusted tax advisor to get an accurate assessment of your eligibility for tax credits.

Remember, this program will be around for a decade as Americans shift away from burning fossil fuels to using high-efficiency electric heat pumps and appliances. Homeowners will have multiple opportunities to cash in on a variety of electrification incentives during that period of time, so take the time up-front to consult with a couple of experts and plan out the best approach for your situation.

Electrification Incentives for NJ Homeowners

The program also includes up-front discounts, generous rebates (available later this year), tax incentives, and low-cost financing available to homeowners who make energy-efficient upgrades to their homes.

Carrier dealers in New Jersey have access to two excellent cost-saving opportunities: the Inflation Reduction Act (IRA) and High-Efficiency Electric Home Rebate Act (HEEHRA).

We have been tracking changes and additions to the Inflation Reduction Act from the outset and are doing everything we can to educate our contractors about the qualifying criteria for homeowners as well as eligible equipment.

Inflation Reduction Act (IRA)

For New Jersey homeowners, the primary opportunity for saving will be around energy savings and the reduction of energy use in general.

The IRA provides a 10-year extension and expansion of 25C, 25D, and 45L tax credits for CEE Highest Efficiency and ENERGY STAR® certified equipment. That means all installations of qualified heat pumps on or after January 1, 2023, are eligible for a homeowner tax credit of up to 30% of the cost of the equipment up to $2,000 in the calendar year.

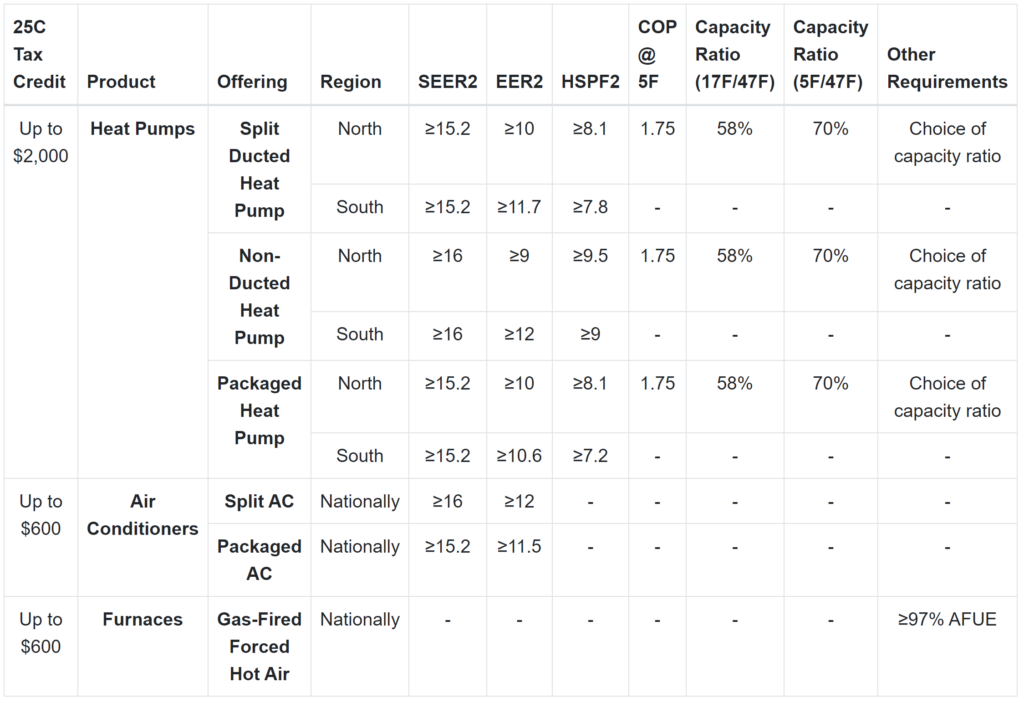

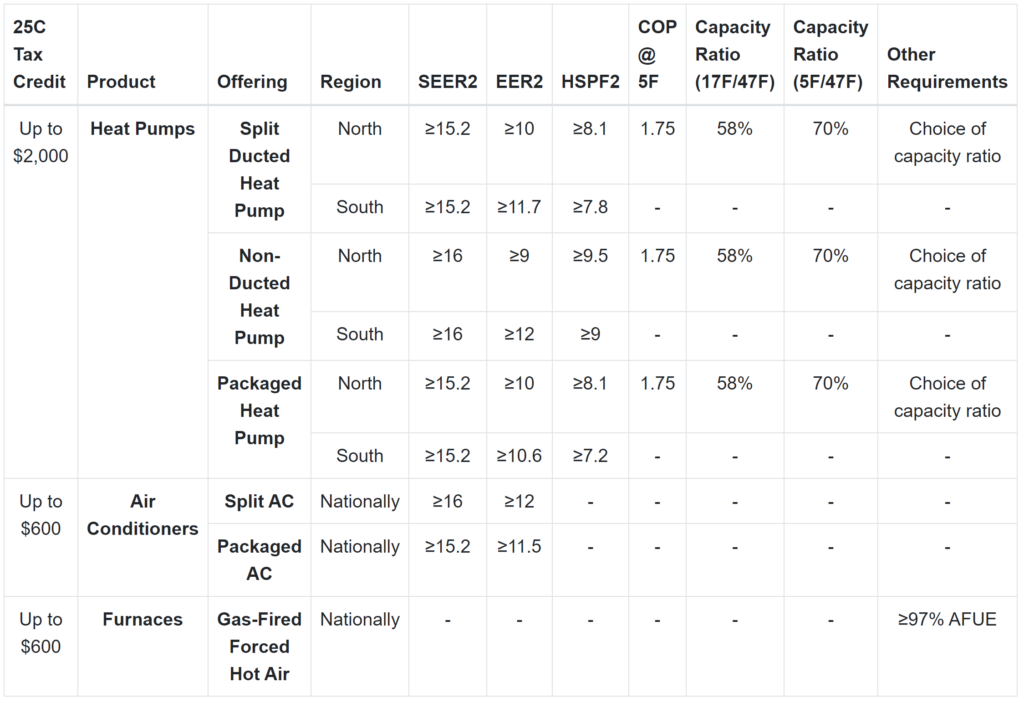

Tax Section 25C, Nonbusiness Energy Property Credit

Effective Jan 1, 2023: Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air conditioners and furnaces, and a maximum of $2,000 for qualified heat pumps.

The IRA significantly expands what these incentives can help pay for to include:

- Doors

- Windows

- Air source heat pumps for both space heating and/or cooling

- Heat pump water heaters

- Rooftop solar

In addition to the tax incentives, the IRA establishes rebates for specified appliances:

- $1,750 for a heat pump water heater

- $8,000 for a heat pump for space heating and/or cooling

- $840 for an electric stovetop or an electric clothes dryer

These incentives will help New Jersey reduce the 26% of its greenhouse gas emissions that come from residential and commercial buildings and achieve its goal of electrifying 90% of buildings.

For renters, the IRA also includes a $1 billion grant program to help make affordable housing more energy efficient (and comfortable!).

The rebate program will not be available to all households. Households earning less than 80% of the median income can qualify for the full benefit. Those earning between 80 – 150% of the average median may be eligible for a partial (50%) benefit.

Rebates will be subject to availability, and the program funds are capped, so they may run out before the ten-year period is over.

High-Efficiency Electric Home Rebate Act (HEEHRA)

HEEHRA is a rebate program designed to help low and middle-income homeowners save up to $14,000 on energy-efficient upgrades.

This program covers up to 100% of electrification projects for low-income households and up to 50% for middle-income earners. It covers the appliance, professional installation, and labor costs.

This is important when swapping out a natural gas furnace for an air source heat pump because most electrical services require upgrading to accommodate the new, high-efficiency equipment.

Here’s a diagram of how a certain homeowner can qualify for HEEHRA:

HEEHRA rebates are available point-of-sale, which means homeowner’s rebates are applied at the time of purchase. It is designed to allow you to save money upfront.

It also helps you save even more money on future utility bills starting immediately!

What’s the Difference Between an IRA Rebate and Tax Credit?

Rebates are up-front savings, which means they are given to the homeowner at the time of sale. It’s up to your authorized Carrier contractor to file the paperwork.

On the other hand, tax credits are the money given back to you when you file your taxes. The tax credits are an annual incentive you can use, amounting to up to $1,200 per year for the duration of the funding.

Think of it this way, you can use the tax credit this year for a new heat pump heating and air system, and next year you can upgrade your home with a new heat pump water heater. That’s two different tax credits for the same energy efficiency improvements.

How Can New Jersey Homeowners Qualify for IRA and HEEHRA Programs?

Eligibility for these programs depends on the location of your residence, your income, and the high-efficiency equipment you and your contractor select.

This is where your Carrier factory-authorized contractor’s experience can really help as they understand what equipment is best for your home and which models will get you the biggest rebates and tax credits.

As I mentioned at the beginning of this article, the program is still being rolled out, so we’re dealing with a bit of a moving target. Check with your local Carrier ductless heat pump expert to find out how they are helping New Jersey homeowners just like you take advantage of this historic opportunity.

Ratings for 25C Tax Credit-Eligible Carrier Equipment